Retire in Pennsylvania: The Hidden Pros and Cons No One Tells You

Thinking about where to retire in Pennsylvania means balancing clear financial wins against surprising trade offs. Pennsylvania can deliver meaningful tax savings, strong healthcare access, and a lower housing baseline than many Northeastern states. At the same time, high property taxes and an inheritance tax can catch families off guard. This guide breaks down the facts so you can decide whether to retire in Pennsylvania with confidence.

Table of Contents

- Why Retire in Pennsylvania?

- Pennsylvania Retirement Taxes

- Housing Costs & Property Taxes for Retirees in Pennsylvania

- Healthcare Options and Access for Seniors in Pennsylvania

- Weather, Lifestyle & Transportation: What to Expect in Pennsylvania

- Philadelphia vs. the Suburbs: Which Is Better for Retirement?

- Best Counties for Retirees: Bucks, Montgomery, Chester & Delaware

- Retirement Planning Tips Most People Overlook

- What to Do If You’re Considering Retiring in Pennsylvania

- FAQs About Retiring in Pennsylvania

Why Retire in Pennsylvania?

Pennsylvania often ranks among the top retirement states for three straightforward reasons: favorable tax treatment of retirement income, relatively affordable housing compared with neighboring New York and New Jersey metros, and a dense network of top‑tier hospitals and specialty care. In practical terms that means Social Security benefits, most pensions, and many 401(k) withdrawals are treated far more kindly under Pennsylvania law than they are in several nearby states, housing costs across much of the state sit below national and regional averages, and the Philadelphia region in particular provides unusually close access to nationally ranked medical centers.

Those three pillars—tax policy, housing affordability, and healthcare access—don’t just look good on a list; they shape day‑to‑day budgeting and long‑term planning. The tax exemptions can reduce or even eliminate state income tax on much of a retiree’s income, lowering monthly outflow and changing withdrawal strategies. A lower median home price across the state translates into smaller mortgage payments or the ability to purchase a larger, more comfortable home, while nearby hospitals and healthy‑aging programs shorten specialist wait times and make coordinated care, at‑home rehab, and hospice services easier to arrange.

That said, these benefits come with important tradeoffs you should factor into any move. Property taxes in many Pennsylvania counties are above the national average, and the state’s inheritance tax means estate planning deserves early attention. In short: Pennsylvania’s strengths can create a very comfortable, affordable retirement for many people, but turn into problems without careful budgeting and a few specific planning steps—run the numbers on your expected retirement income, estimate true annual housing costs including taxes, and confirm healthcare access in the counties you’re considering.

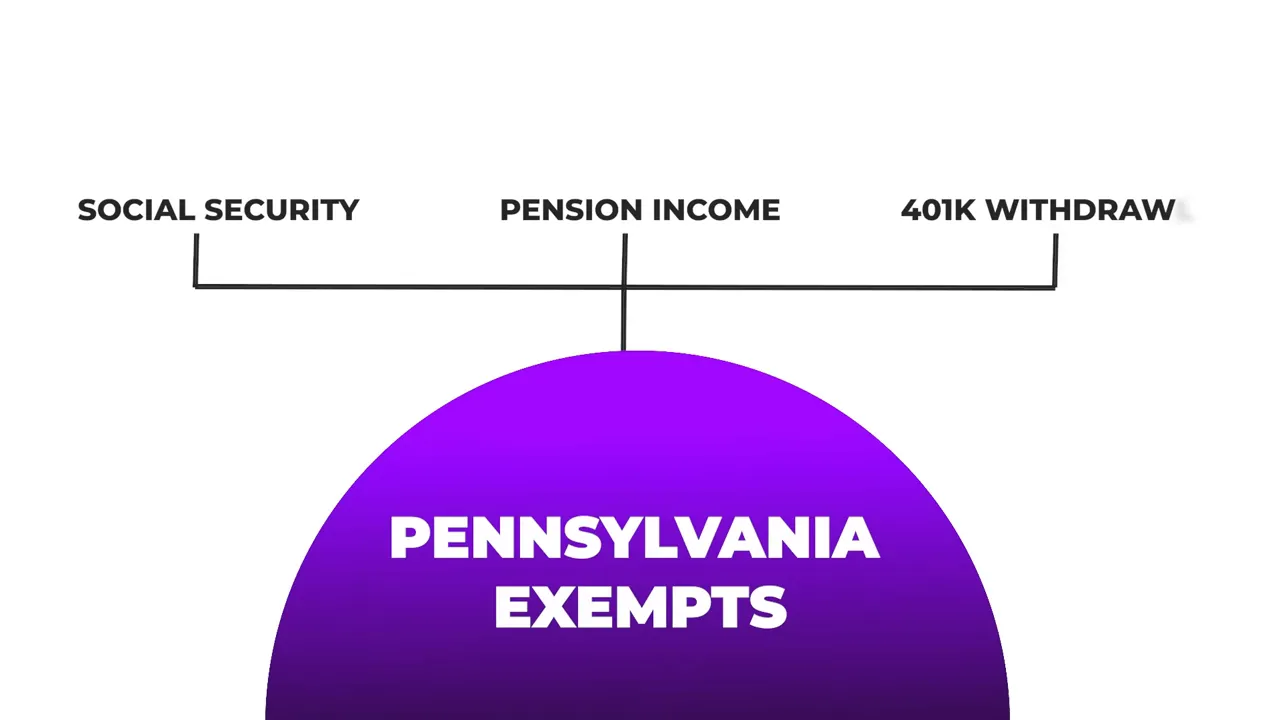

Pennsylvania Retirement Taxes

Retirement income tax treatment is the single biggest reason many people choose to retire in Pennsylvania. Social Security benefits, most pensions, and 401(k) withdrawals are exempt from state income tax. Pennsylvania’s flat rate of 3.07 percent applies to other types of taxable income, but for many retirees that exemption on retirement income results in dramatically lower state taxes.

That advantage helps explain why people who could retire in Pennsylvania sometimes choose it over neighboring states where middle income retirees may pay thousands more each year in state taxes. If you want to compare your numbers, run a worksheet listing Social Security, pension, and taxable distributions to see how moving to retire in Pennsylvania would change your annual state tax bill.

Housing Costs & Property Taxes for Retirees in Pennsylvania

Pennsylvania’s statewide median home price sits well below the national median, and even the Philadelphia region is generally cheaper than comparable New Jersey or New York suburbs. However, property taxes are among the highest in the country on average. That makes the sticker price of a home only one piece of the cost picture when you retire in Pennsylvania.

Use a property tax reality check: pick a target home price and the county you are considering, then calculate the annual tax bill. Many counties provide different rates, and programs like the property tax and rent rebate can return up to $1,000 a year to eligible seniors. The net effect: buying in a lower tax county or in the city can offset otherwise high county rates.

Healthcare Options and Access for Seniors in Pennsylvania

One of the strongest arguments to retire in Pennsylvania is access to healthcare. The Philadelphia region contains nationally recognized systems such as Penn Medicine and Jefferson Health, along with several hospitals ranked among the best in the country. For retirees, this means shorter wait times for specialists, Medicare acceptance across major institutions, and dedicated healthy aging programs that coordinate complex care.

The density of providers also supports at home care, rehab, and hospice services that are coordinated by hospital networks. For anyone who values quick access to high quality medical care, that concentration is a major benefit of deciding to retire in Pennsylvania rather than a more dispersed retirement hotspot.

Weather, Lifestyle & Transportation: What to Expect in Pennsylvania

Pennsylvania offers four distinct seasons. Many retirees appreciate colorful falls and mild springs. Winters bring snow and colder temperatures—Philadelphia averages about 22 inches of snow per year—so factor in snow removal, winter driving ability, and fall-related safety concerns when planning to retire in Pennsylvania.

Transportation depends on where you choose to live. Philadelphia itself is highly walkable with extensive public transit. Suburban life usually requires a car, and AAA estimates ownership costs in the Philadelphia suburbs between $8,500 and $10,000 per year. Factor those costs into a full retirement budget.

Philadelphia vs. the Suburbs: Which Is Better for Retirement?

Choosing to retire in Pennsylvania can look very different depending on whether you pick the city or the suburbs. The city offers surprisingly affordable housing for a major urban center, with median home prices lower than many suburban areas and property taxes under 1 percent. You gain walkability, museums, restaurants, and transit access.

The downside is concentrated crime in some neighborhoods, so pick neighborhoods carefully. Suburban counties offer more variety, from small town charm to affluent rural stretches. Each county comes with its own trade offs between price, safety, and amenities.

Best Counties for Retirees: Bucks, Montgomery, Chester & Delaware

- Bucks County: Small town charm, high senior population, excellent hospitals, median home prices higher than many suburban counties.

- Montgomery County: Wide variety, strong hospitals, good shopping and dining, strong commuter access, midrange home prices.

- Chester County: Rural, scenic, top tier hospitals, highest suburban prices—ideal for those seeking space and quiet.

- Delaware County: Most affordable of the four, walkable towns with regional rail access, easy city proximity.

If these county differences feel overwhelming, make a short list of priorities—budget, healthcare access, walkability—and eliminate counties that don’t meet your baseline before you visit.

Retirement Planning Tips Most People Overlook

Two planning items regularly surprise families who plan to retire in Pennsylvania: the inheritance tax and property tax burden on fixed incomes.

Pennsylvania’s inheritance tax rates apply broadly: for example, 4.5 percent to children, 12 percent to siblings, and higher rates to other beneficiaries. This is not an estate tax reserved for the very wealthy; it can affect middle class families. Consider estate planning moves—beneficiary designations, trusts, or life insurance—after consulting with an attorney.

Property taxes can vary dramatically by county. A home valued at $400,000 might carry wildly different yearly tax bills depending on location. Identify the true annual housing cost including taxes, and test your budget against worst case scenarios like needing to outsource snow removal or pay for home maintenance.

What to Do If You’re Considering Retiring in Pennsylvania

Work through a tax impact worksheet to model how exempt retirement income will affect your state tax bill. Make a short list of counties and towns to visit that match your budget and healthcare needs. Build a three step plan for estate planning to address inheritance tax exposure. Finally, run the numbers for total housing cost including property taxes, insurance, and likely winter expenses.

Deciding to retire in Pennsylvania is rarely obvious. The state wins on healthcare and retirement income tax treatment, but you trade off winters and property taxes. With careful planning you can turn those strengths into a retirement that is both affordable and secure.

Ready to run the numbers for your Pennsylvania retirement? Reach out to me at 267-718-5695 and I’ll help you compare counties, taxes, and healthcare so you can make a confident decision.

FAQs About Retiring in Pennsylvania

Does Pennsylvania tax Social Security and pension income?

Social Security benefits, most pensions, and 401(k) withdrawals are exempt from Pennsylvania state income tax, which can significantly reduce state tax bills for retirees.

How big of a problem are property taxes when you retire in Pennsylvania?

Property taxes are higher than the national average and vary by county. Comparing annual property tax bills for your target home price is essential. Programs like the property tax and rent rebate can provide relief for eligible seniors.

Is healthcare easy to access if I retire in Pennsylvania?

Yes. The Philadelphia region has a high concentration of nationally ranked hospitals and healthy aging programs, which generally leads to shorter specialist wait times and broad Medicare acceptance.

Should I choose the city or the suburbs to retire in Pennsylvania?

It depends on priorities. The city offers walkability, lower property tax rates, and transit access. Suburbs offer more space and quieter neighborhoods but typically higher property taxes and the need for a car.

How can I reduce inheritance tax exposure when I retire in Pennsylvania?

Work with an estate attorney to review beneficiary designations, consider trusts or life insurance, and explore strategies that fit your family situation. The inheritance tax affects many estates, so proactive planning is important.

jim stevenson

Thinking about moving to the Philly Suburbs? You're in the right place.

I'm Jim Stevenson, born and raised in Bucks County, now raising my three kids in Chalfont. After years in DC, my wife and I came back because this region is unmatched: historic charm, top schools, walkable downtowns, and that perfect blend of rural beauty with city access.